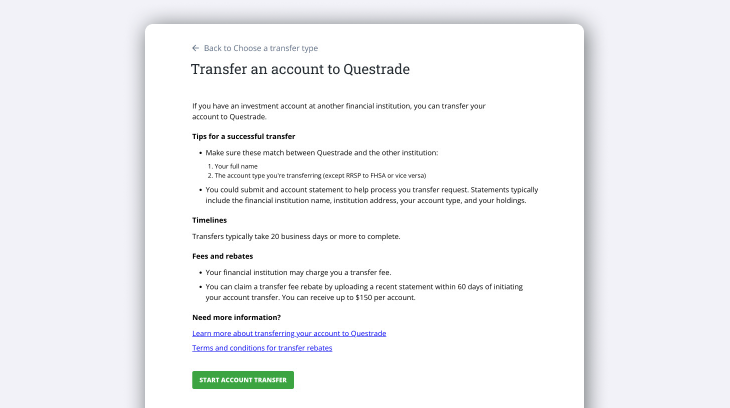

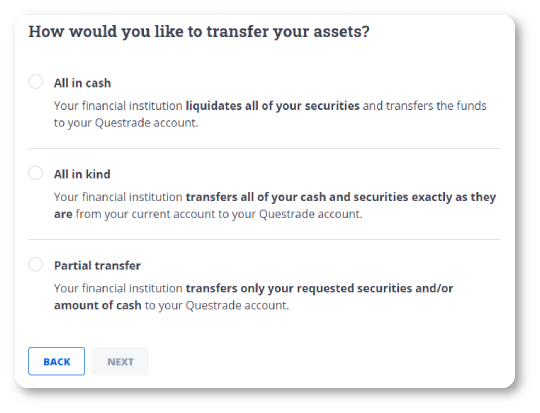

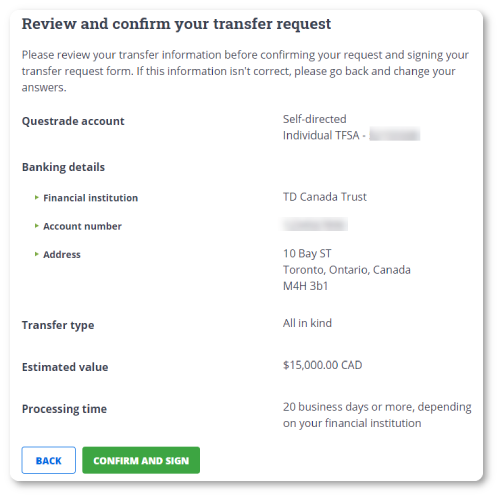

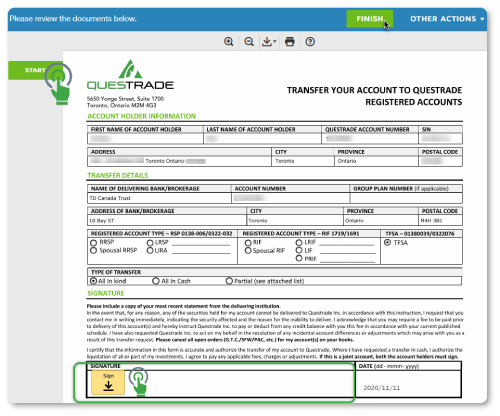

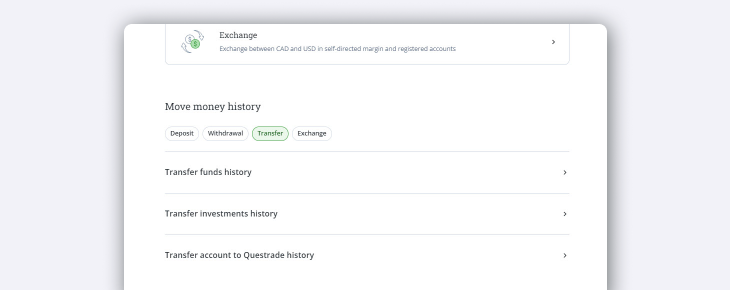

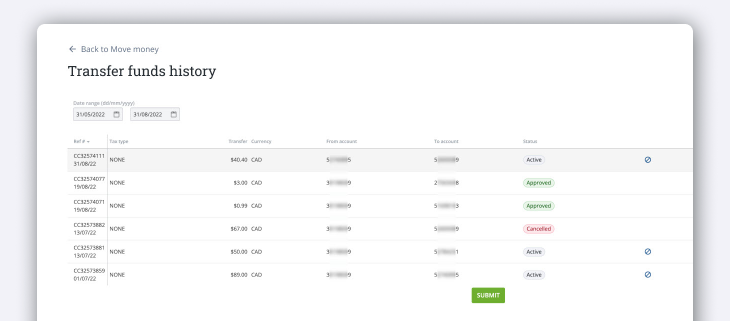

Whether you’re new to Questrade or already a customer, you can transfer almost any type of investment account over to Questrade—for any amount and as many accounts as you like. You can transfer your cash or your actual investments (referred to as an in-kind transfer).

And the best part? We’ll cover your transfer-in fees, for up to $150 per account.