Index

- How do I qualify for this offer?

- What is the offer?

- What is the duration of the offer period?

- Is there a minimum funding amount to qualify for the cash back?

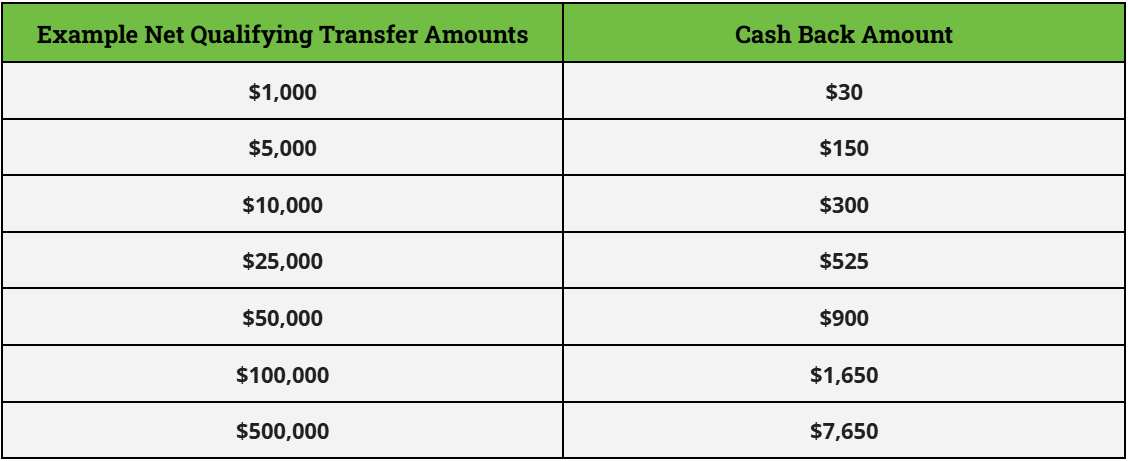

- How much can I earn?

- What accounts can I transfer into?

- How are Joint Accounts and Entity Accounts handled?

- What are Qualifying Deposits and where can my transfers come from?

- How long do I have to transfer my funds?

- Do multiple transfers count towards my net funding total?

- Do I have to pay transfer fees for external transfers from another institution?

- How is the cash back calculated?

- How will I receive my cash back?

- When will I receive the first cash back payment?

- Where will I be able to find my first cash back payment?

- What if I don't have a Cash or Margin account to receive my cash back payment in?

- Which account will the cash back be paid to if I have both a Cash account and a Margin account?

- How long do I have to keep my transfers in my account at Questrade?

- How much money can I withdraw without impacting my cash back?

- I’ve withdrawn money. Can I get my full cash back amount again?

- How much can I withdraw if my account grows in value?

- Will market fluctuations impact my cash back?

- What are the tax implications of this offer?

- Can I be eligible for multiple offers at once?

- How will USD assets be treated?

- What happens if I decide to close my account?