Placing a trade with QuestMobile is simple and straightforward. Follow these steps for a successful first trade:

Lesson Explore QuestMobile

Placing a trade

Learn the ins and outs of placing a trade using QuestMobile.

Please note: The following quotes and ticker symbols are for educational purposes only.

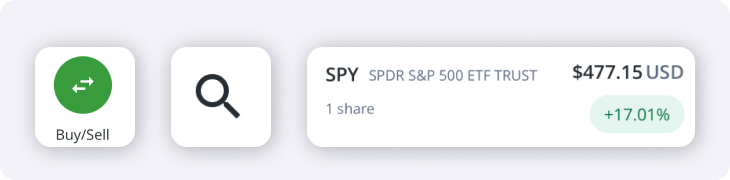

- Navigate to the Stock/ETF Quote page in any of the following ways:

- Tap the green Buy/Sell button from the homepage

- Tap the magnifying glass icon from the top right

- Tap on any symbol from your positions, or watchlists

On the Quote page, you will find information about the stock or ETF, including a historical performance chart, and key Statistics below (dividends, P/E, Volume, etc.).

- Tap the Buy or Sell button at the bottom of your screen.

If you're placing a buy order:

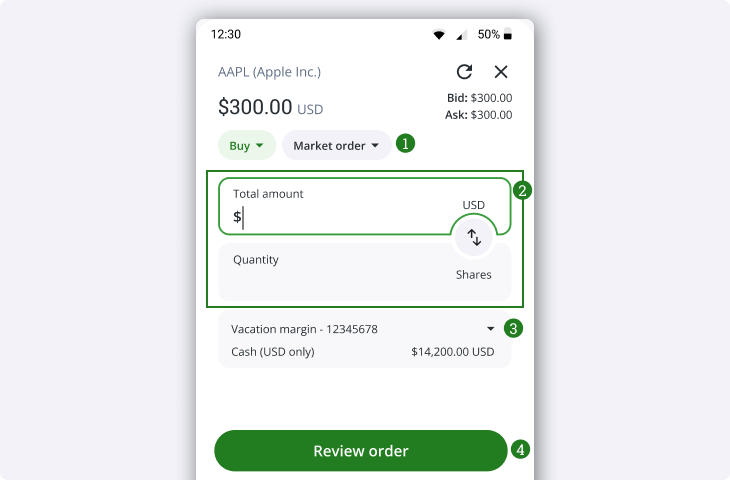

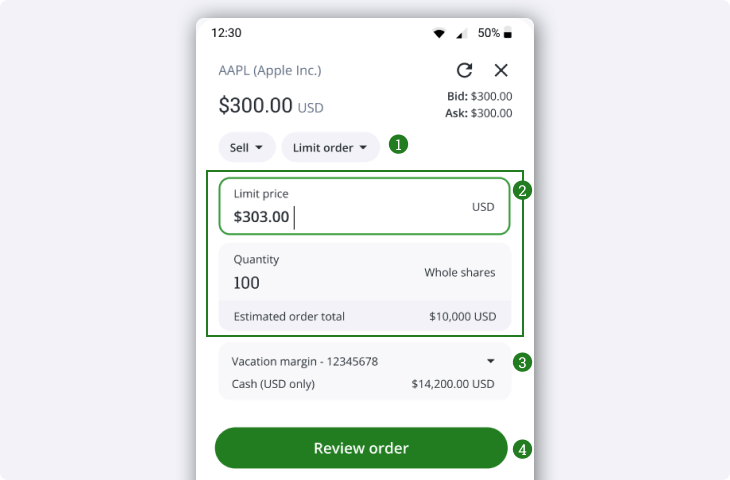

You will see the above order entry screen.

- Choose the order type from the drop-down at the top of the order entry.

- Market orders will immediately buy or sell shares at the best available price, and can buy fractional shares of applicable securities. For most users, this will be the default order type.

- Limit orders let you set the price at which you want to buy or sell the shares, and the trade will only execute at the target price or better.

- Note: Fractional shares can only be purchased or sold using Market orders.

- Enter either the total amount you would like to spend, or the total quantity you would like to buy.

- If you are filling out a market order, filling out one field will auto-populate the other with an estimate based on current market prices.

- If you are filling out a limit order, you will need to include both the quantity of shares you want to buy and the price at which you want to buy them.

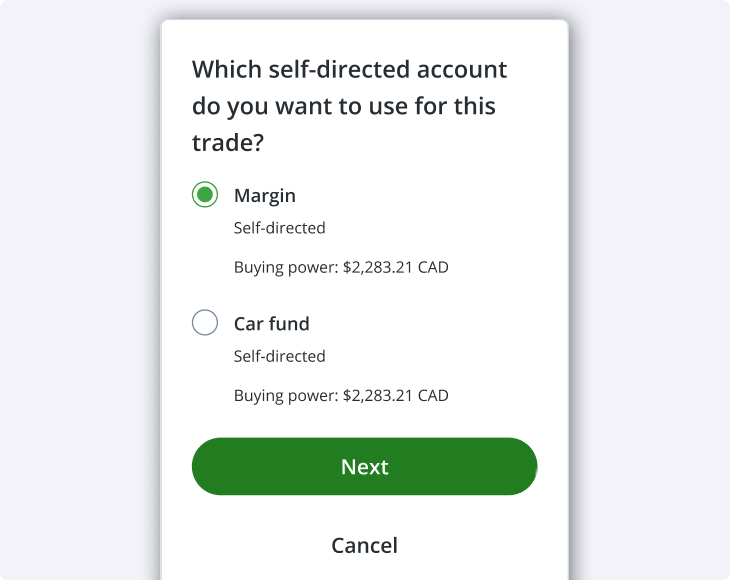

- You can change the account you would like to use to place the order from the drop-down.

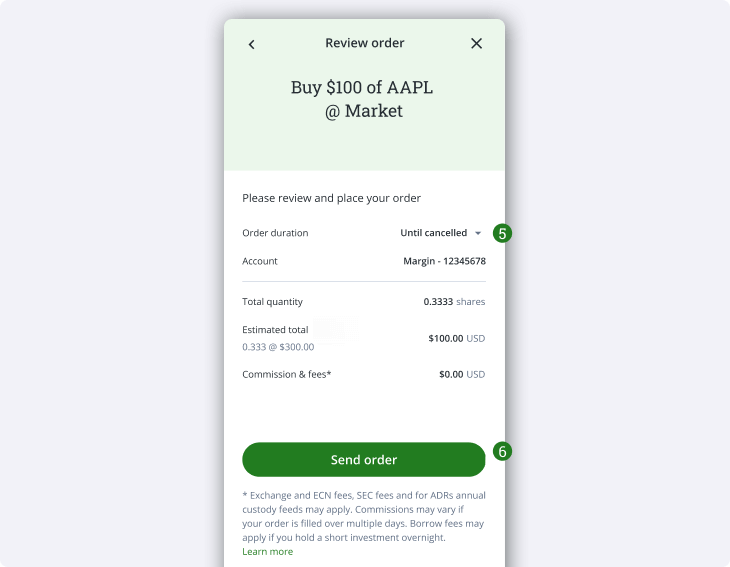

When you’re satisfied with the order, click Review order. This will take you to the following confirmation screen, where you can review the details of your order:

- If you are placing a limit order, you can use the drop-down here to set the order duration.

- Once you’re satisfied with the details and duration, click Send order to place your trade.

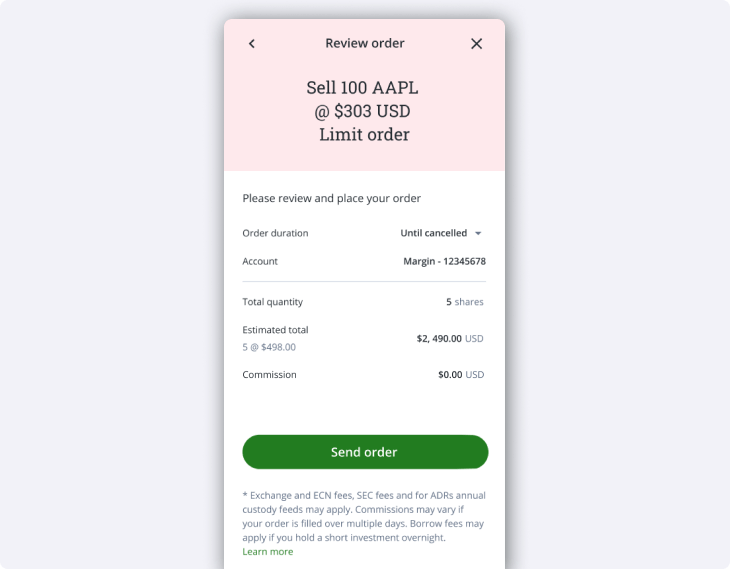

If you're placing a sell order:

You will see the above order entry screen.

- Choose the order type from the drop-down at the top of the order entry.

- Market orders will immediately buy or sell shares at the best available price, and can sell fractional shares of applicable securities. For most users, this will be the default order type.

- Limit orders let you set the price at which you want to buy or sell the shares, and the trade will only execute at the target price or better.

- Note: Fractional shares can only be purchased or sold using Market orders.

Note: If you’re looking to use advanced order types (including trailing stop orders, bracket orders, etc.), please use Questrade Edge Mobile.

- Enter the quantity of shares that you want to sell, and for limit orders the limit price at which you would like to sell them.

- Since market orders sell for the best available price, the price field will not show up when selling by market order.

- You can change the account you would like to use to place the order from the drop-down.

- When you’re satisfied with the order, click Review order. This will take you to the confirmation screen, where you can review the details of your order:

- If you are placing a limit order, you can use the drop-down here to set the order duration.

- Once you’re satisfied with the details and duration, click Send order.

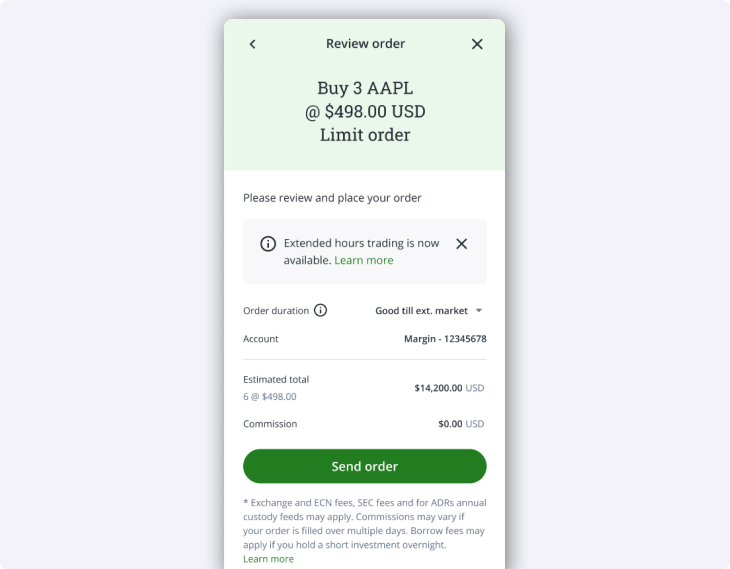

Trading during Extended and Overnight trading sessions

Take advantage of Extended (which includes Pre-Market and Post-Market hours) and Overnight trading opportunities within the Questmobile platform.

North American stock markets operate from 9:30 am ET to 4:00 pm ET, Monday to Friday. There are also 2 separate trading sessions where you can continue to trade outside of regular trading hours: Extended markets trading (which includes pre-market and post-market) and Overnight trading.

To set your order to activate during extended market hours (4am- 9:30am and 4pm - 8pm ET) on QuestMobile:

- Select a limit order from the Order entry window on the Trading page (as described above in step 4).

- Click on the order duration and change it to Good till ext. market (GTEM), then place your order.

- Good till ext. market means your trade order remains active for the entire trading day, from 4am - 8pm, including during regular market hours. If it is not filled by 8pm, it will be cancelled.

To set your order to activate during overnight market hours (8pm - 2am ET) on the Questrade trading platform:

- Select a limit order from the Order entry window on the Trading page (as described above in step 4).

- Click on the order duration and change it to Overnight, then place your order.

- Overnight means your trade order will remain active only between 8pm and 2am ET. If it is not filled by 2am, it will be cancelled.

Learn more about order types and durations.

Pre-market and overnight trading for Canadian securities is unavailable, and there are only limited options for post-market trading of Canadian stocks and ETFs.

Disclaimer: Securities shown are for illustrative, educational, and visual purposes only, and should not be relied upon as financial advice. The information provided is not intended to be and should not be construed as a recommendation, offer, or solicitation to buy or sell.

Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Related lessons

Want to dive deeper?

How to open an account

Learn what you need to know when opening a self-directed or Questwealth Portfolios account.

View lessonRead next

Making your first trade

Learn how to make your first trade, read order status, and understand trade executions in our trading platforms.

View lessonExplore

Questrade trading platforms

Discover all of Questrade’s trading platforms and decide which one is best suited for you, and your investment style.

View lesson