Options trading can sometimes throw a curveball, especially when a company goes through significant changes like stock splits/consolidations or mergers. Adjusted options are the market's way of addressing these changes.

This article will explain what adjusted options are, how they come into play during corporate actions, and what traders should know in order to manage their option contracts effectively.

Adjusted options exist when the original terms of the option contract are amended due to a corporate action or reorganization.

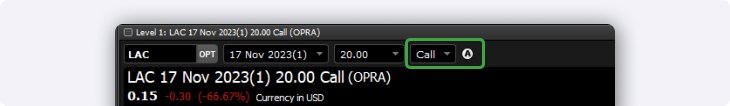

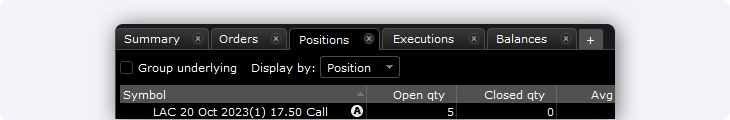

Critical parts of the option contract may be changed such as the strike price, symbol, deliverable, and the amount of shares represented by each contract.