Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Margin 101

Borrowing money in margin accounts

Learn what borrowing money in your margin account does

If you have a negative listed cash balance in your margin account, that means you are currently borrowing money.

Your margin account will automatically borrow money whenever you make a trade that is not covered by the available cash of the currency of the trade in your account.

Before you trade on margin, you will see a screen warning that you are about to borrow money.

Also, it’s important to remember that your margin account does not automatically convert currencies, so if you have cash in one currency and make a trade in the other, you will be borrowing to make that trade.

For example: If you deposit $1,000 CAD (Canadian Dollars) into your margin account and purchased $500 worth of shares of an American-listed stock, you will see a positive cash balance in CAD and a negative balance in USD (US Dollars):

If you do not want to borrow in your margin account, make sure you manually convert your cash to the appropriate currency by placing a currency exchange request before making a trade. You can also free up the necessary cash to avoid borrowing by selling shares or depositing funds of the desired currency.

Keep in mind that borrowed funds will accrue interest, so if you did not intend to borrow, make sure that you return yourself to a positive balance ASAP.

Interest charges start to accrue when you end the trading day with a negative balance, and are charged to your account every month. Applied charges will show up in your Account Activity screen, found under the Reports tab at the top of your screen.

If you’re shorting stocks in your account

Please keep in mind that cash received when you open a short position will not count towards your margin balance. If you are shorting stocks, it is possible to have a positive listed cash balance, but still be borrowing on margin.

Why you are able to borrow USD money with CAD cash in your account

Borrowing is a key feature of margin accounts that is not available in registered accounts. Being able to leverage CAD cash and shares to borrow USD money accommodates some trading strategies that save on currency conversion fees. However, remember that borrowed funds will accrue interest, so make sure that it fits your investing strategy.

Placing a currency exchange request

Placing a request online is easy, follow these steps to exchange the cash in your account between CAD and USD (or vice-versa).

- Log in to your account

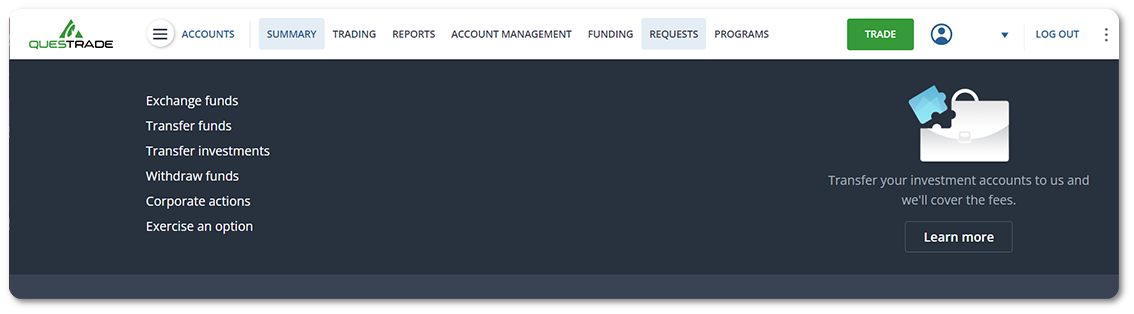

- Hover over the “Requests” navigation menu at the top of the page, and click “Exchange funds”

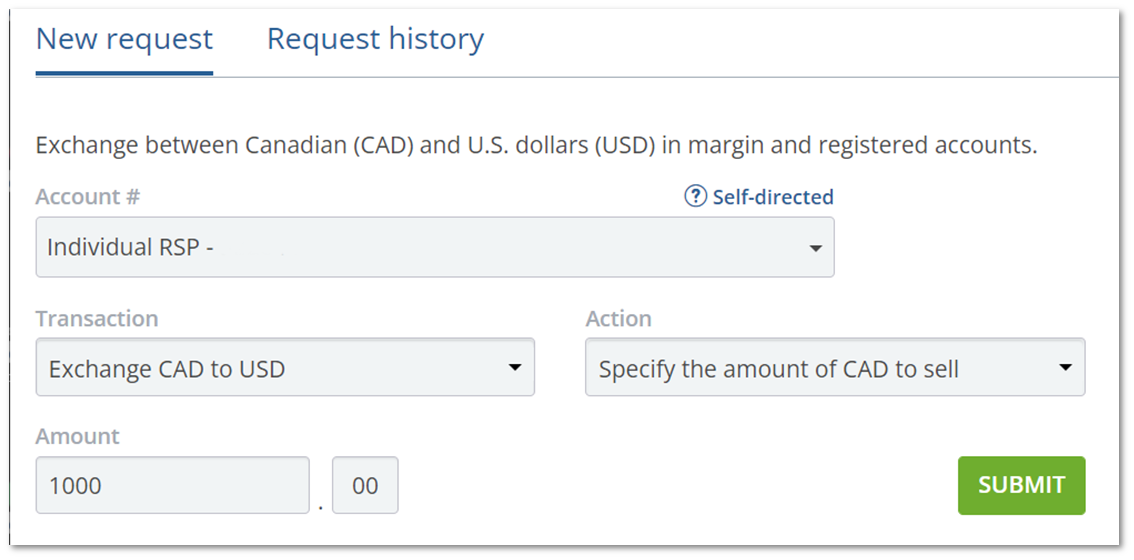

- Select the account you’re placing the request for in the drop down menu at the top.

- Choose your desired transaction, the two options are:

- Exchange CAD to USD

- Exchange USD to CAD

- Specify the amount of CAD or USD you’d like to either buy or sell, in the action field

- If you’re exchanging CAD to USD, you can either choose a specific amount of CAD to sell, or USD to buy

- If you’re exchanging USD to CAD, you can either choose a specific amount of USD to sell, or CAD to buy

- Enter the dollar amount you’d like to exchange

- Click the green Submit button when you’re ready

Congrats, you’ve finished placing your currency exchange request. You can view your Request history by clicking the tab at the top.

Important to know

- Requests placed before 2:30pm ET will be processed around 4pm ET the same day

- Requests placed after 2:30pm ET are processed on a best effort basis the same day

- If the request is not able to be processed the same day, it will be exchanged the following business day

- Due to conditions beyond our control such as exchange volume, we cannot guarantee that your request will be processed on the same day if placed after 2:30pm ET

- You can cancel a request that has not been processed yet by heading to the Request history tab

- You cannot exchange funds in a Questwealth Portfolio account

Related lessons

Want to dive deeper?

TFSA 101

Discover what a Tax-Free Savings Account is and how it can benefit your investment goals.

View lessonExplore

Accounts 101

Explore the different account types available in Questrade and determine the right account for you.

View lesson