Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson How to set up financial goals

How asset allocation can help protect your investment goals

See how asset allocation can impact your investment goals.

- How asset allocation helps you invest

- How your asset allocation ties to your portfolio risk level

- Which free tools are available to help you set up and maintain your asset allocation plan

Understanding what asset allocation is and how it’s used can be essential when building towards your investment goals. After all, asset allocation can have a major impact on how your portfolio will perform over the short and long-term.

Like most things in investing, there’s no universal right way to do it—the better you understand asset allocation, the better you can determine which strategy best suits your unique goals.

How asset allocation helps you invest

Asset allocation is a part of every portfolio, whether or not it’s planned out. If you’ve got investments, then asset allocation is already playing a part in how those investments react to the market.

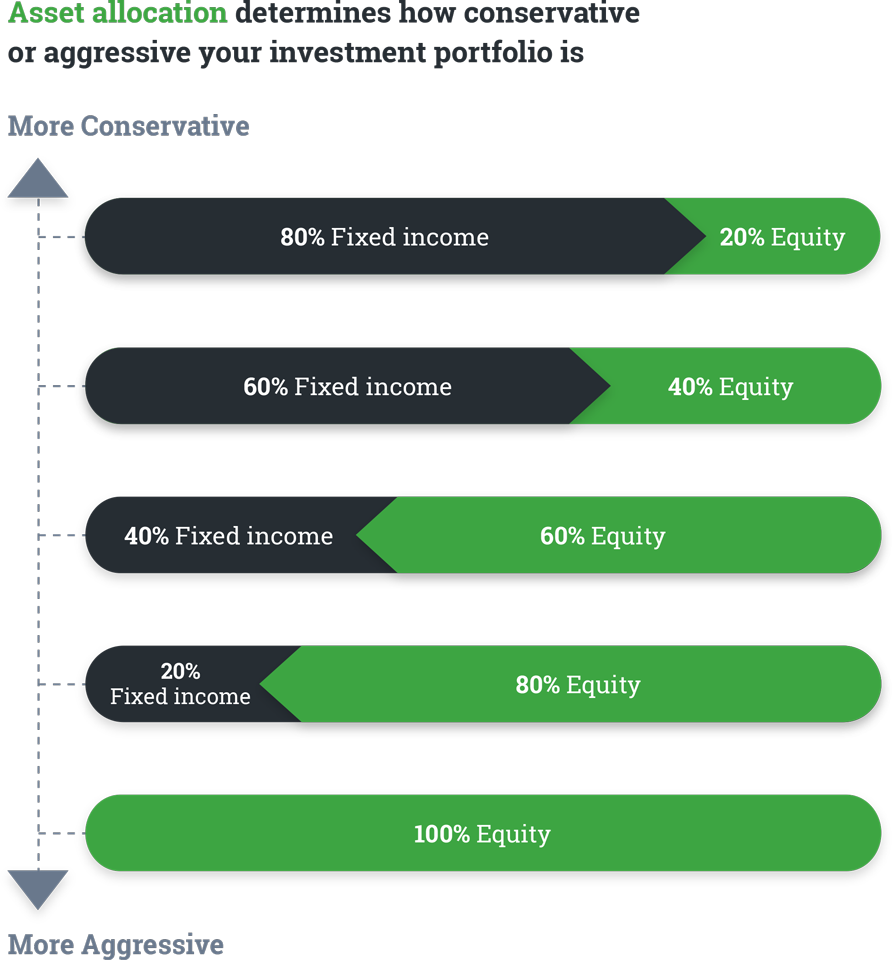

Asset allocation is the way you split your investment portfolio between higher risk/reward assets (like stocks and other equities) and lower-risk assets (like bonds and other types of fixed income).

How does that benefit you? The percentage you allocate to each, determines how risky your portfolio will be.

More fixed income = less change in your portfolio’s daily value but typically less overall gain over the long term (commonly known as more “conservative”).

More equities = more change in your portfolio’s daily value but typically a higher overall gain over the long term (commonly known as “growth” or“ aggressive”).

Where a portfolio falls on this spectrum will be different for everyone. How your portfolio is split will depend on how long you are investing for and how comfortable you are with swings in your portfolio. Generally, planning to stay in the market for a longer period of time will increase the amount of risk your portfolio can tolerate. And typically, the less comfortable you are with bigger changes, the more conservative your portfolio should be.

When the markets are uncertain, stocks tend to experience big swings due to major global events. In these cases, a more aggressive portfolio will be more prone to those swings on a daily basis. But remember, while the market will often enter periods of volatility, stocks and equities have historically produced greater returns in the long-term.

Want help setting up and managing your portfolio’s asset allocation?

There are a number of tools that can help you track your asset allocation, from basic spreadsheets to dedicated programs that link directly to your investment account. Passiv is one such tool that was developed to link with your Questrade account. It helps track your asset allocation by allowing you to set how much of each investment type you want allocated in your portfolio and keep track of it for you. If your portfolio strays from the allocation you set, it will send you a notification. And it will also notify you when you receive dividend income to reinvest.

Asset allocation is a part of everyone’s portfolio, but it’s not always a part of their strategy. To make sure that your investments suit your long-term goals, it’s important to be mindful of your portfolio’s asset allocation. Now is as good a time as any to look at your portfolio and spend some time figuring out what allocation mix is right for you.

If you enjoyed this post, please consider sharing it on Facebook or Twitter!

Related lessons

Read next

Investing foundations

Understand the fundamentals and major concepts in investing to help you build a solid investing foundation.

View lessonExplore

Accounts 101

Explore the different account types available in Questrade and determine the right account for you.

View lesson