Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Navigating market volatility

Investing during a crisis: how markets have recovered in the past

Learn how markets have historically recovered from a crisis.

- The impact to the market from COVID-19 is unprecedented but not entirely new

- How bull and bear markets performed in the past

- What you should do in times of high market volatility

In addition to the health concerns that come with COVID-19, we’ve seen unprecedented volatility in the stock markets. At times like these it can be easy to forget that these types of events have happened before. Historically while markets pull back in times of disruption and crisis they have usually recovered those losses and more in the years that followed, and, when viewed over the long term, provided positive return.

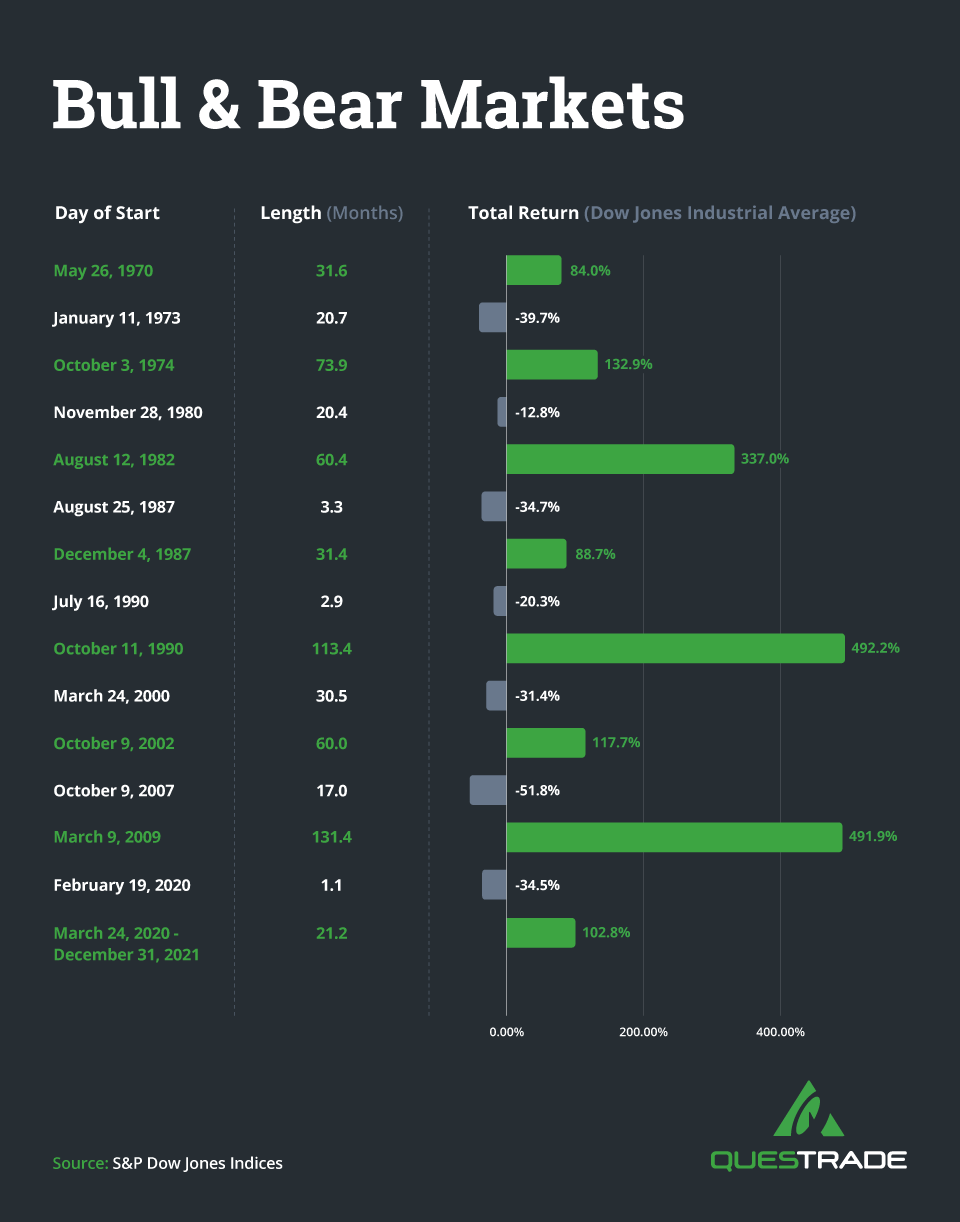

The below chart shows how the U.S. stock market based on the S&P Dow Jones Indices has rebounded from different crises and the performance of specific bear and bull market periods.

As you can see, the DJIA index in the visual above has not only recovered from past losses but has gone on to have huge returns. Even the financial crisis of 2008 was followed by a period where the return exceeded 400%. While history is not a predictor of what might happen in this situation hopefully it does provide some helpful context for you about the recovery from prior significant events.

So while in the short term it is easy to panic, over the long term the benefit from regular investing could be strong. Remember, we are always here to help and support you because we care deeply about helping all Canadians achieve long term financial success and security. And we wish you the very best in health during these challenging times.

If you enjoyed this post, please consider sharing it on Facebook or Twitter!

Related lessons

Want to dive deeper?

Investing foundations

Understand the fundamentals and major concepts in investing to help you build a solid investing foundation.

View lessonExplore

What is the stock market and how does it work?

Become familiar with the stock market and how it works.

View lesson