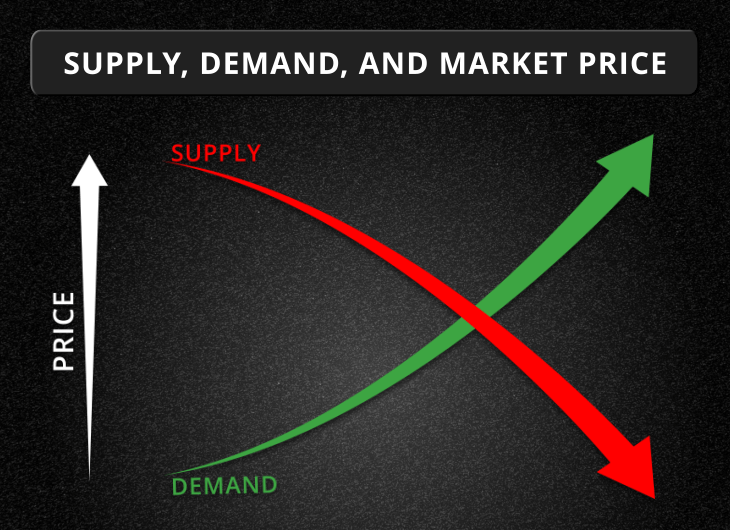

Traditionally when you’re holding an investment, the stock or ETF will sit in your account while the underlying asset (usually the issuing company) makes you money through growth and dividends.

But what if you could put that stock to work?

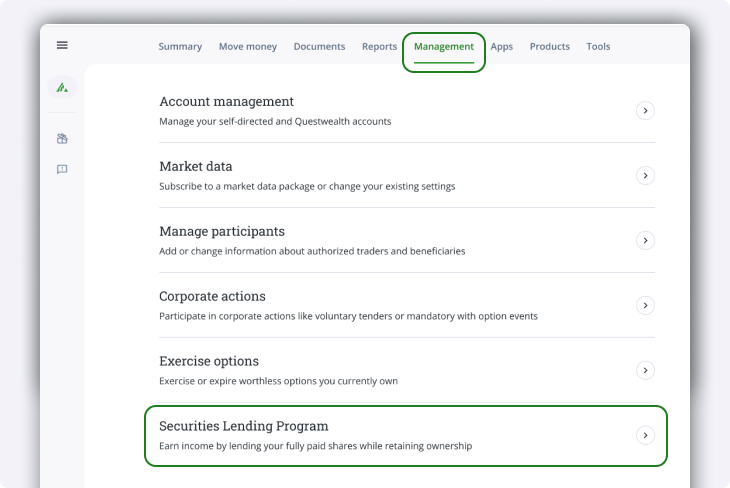

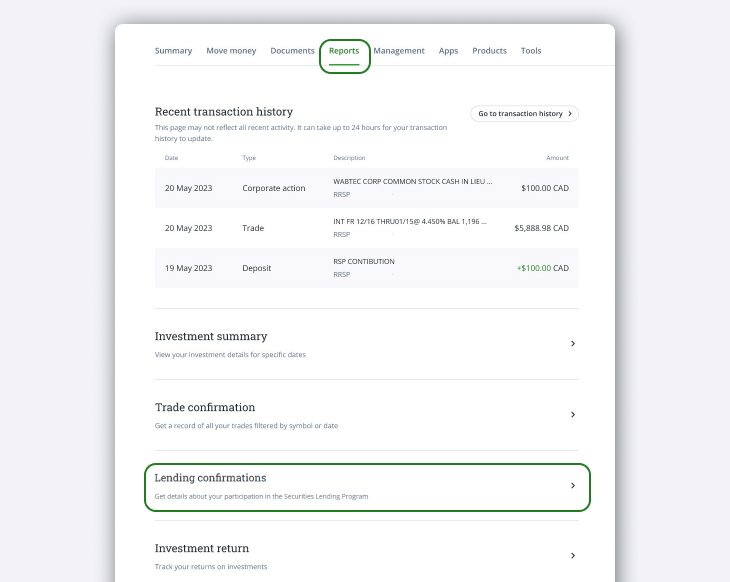

With Questrade’s Securities Lending Program, you can.