When you’re new to options, it can be difficult to picture how they work. Here are a few hypothetical examples of options transactions to help you better understand the basics.

Lesson Introduction to options trading

Practical examples of options trades

Here are some examples to help you understand exactly how options contracts work.

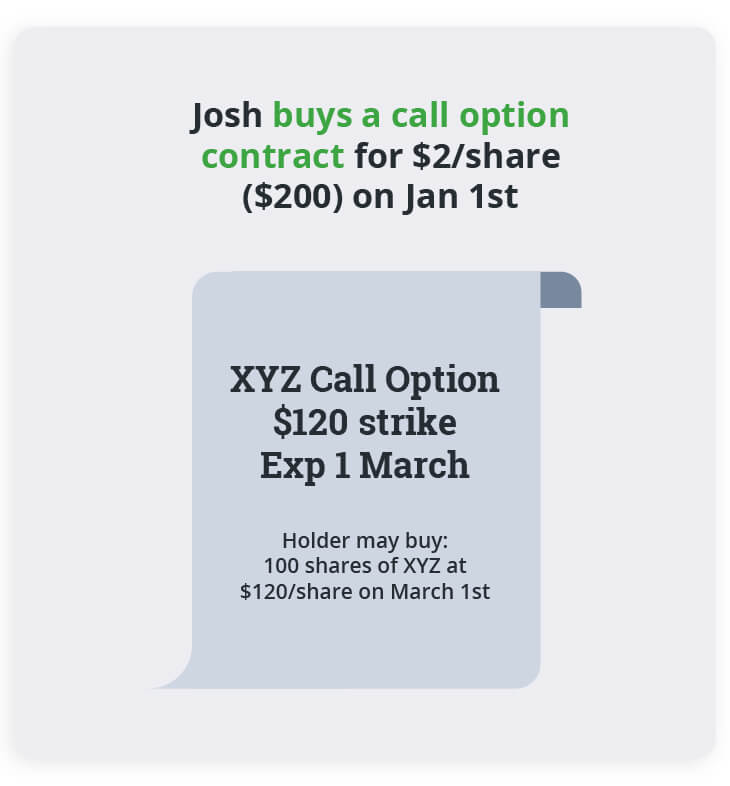

Example 1 - Buying a Call:

Josh is an investor who’s closely following company ‘XYZ’ trading at $100 per share and expects them to rise in price. In anticipation of this price increase Josh buys a call option on XYZ with a strike price of $120, and an expiration date 2 months out. This gives Josh the right, (but not the obligation) to buy 100 shares of XYZ for $120 per share before his call option expires worthless.

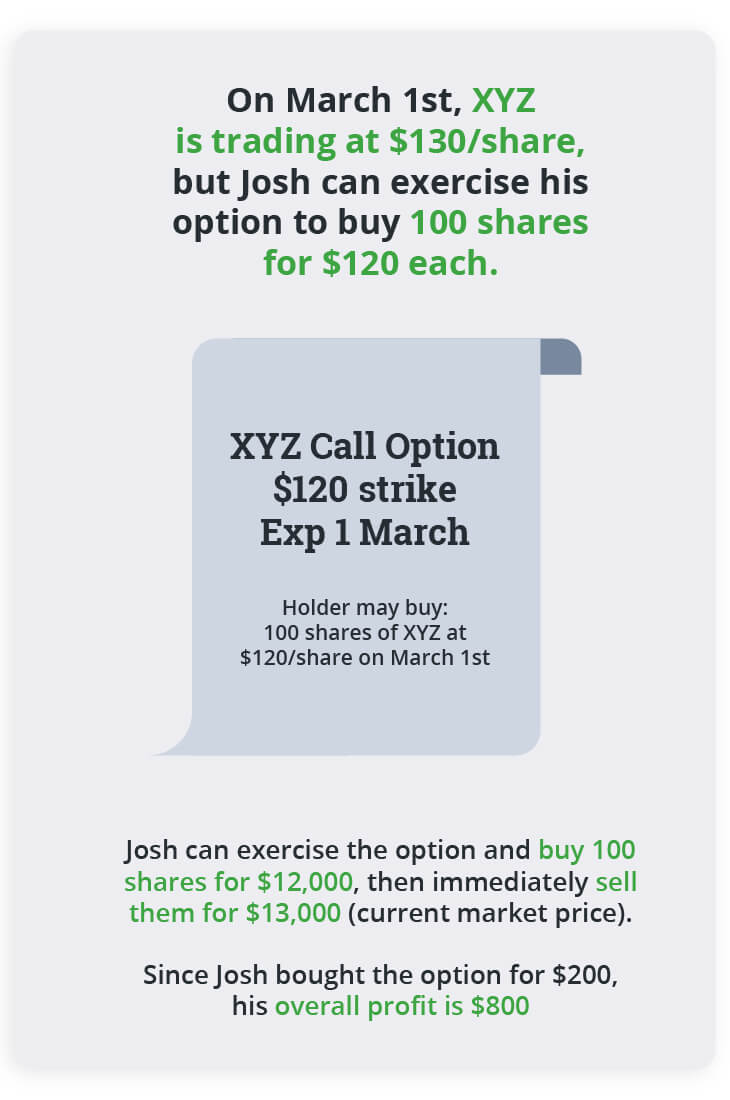

If XYZ rises in price sharply to $130 per share, Josh can exercise his option contract’s rights, and buy 100 shares of XYZ at $120 from the original seller of the options contract. In this example, Josh could profit $10 per share since he can buy XYZ at $120, and immediately sell it into the market for $130 per share. In a real-world scenario, Josh would subtract the premium he paid originally from his overall profit. If he paid a $2 premium for the call option, this reduces his profit to $8 a share.

Rather than exercising his call option, Josh can also choose to sell it back into the market before the expiration date. He could potentially profit off the increase in intrinsic price since the option is now in-the-money. This way he doesn’t have to deal with exercising the call, taking delivery of the shares, then having to sell them.

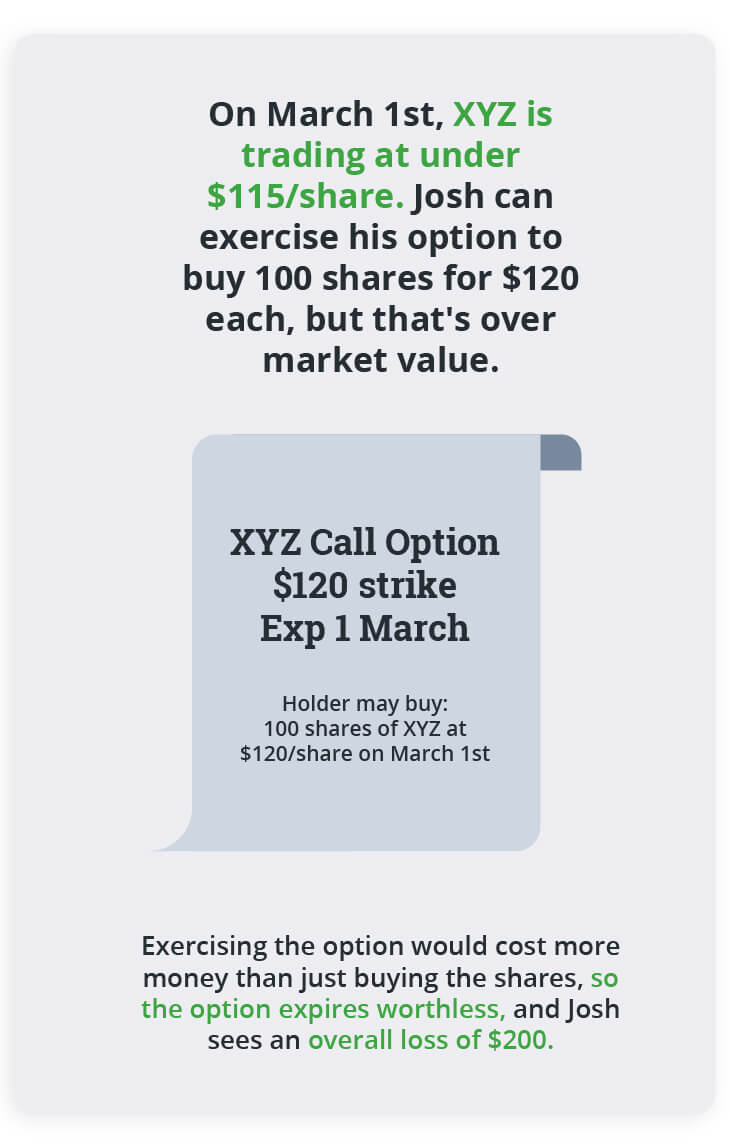

If XYZ only rises to $122, or lower, ($120 strike price + $2 premium paid) Josh’s call option would not be profitable to exercise, and his contract would likely expire worthless. He can try to sell it back to the market before the expiration date, but due to the time decay, he will most likely have booked a loss on the trade.

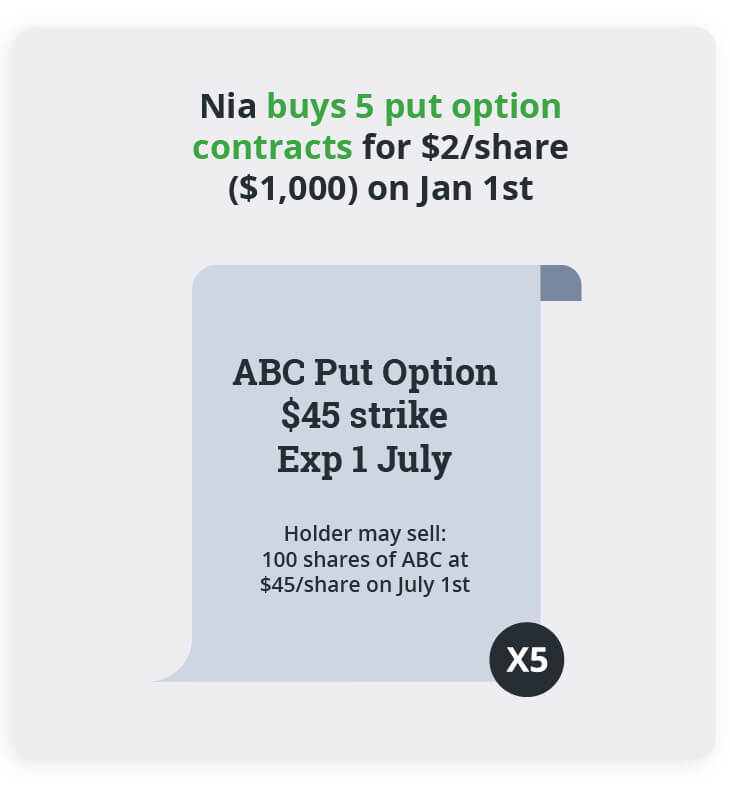

Example 2 - Buying a Put:

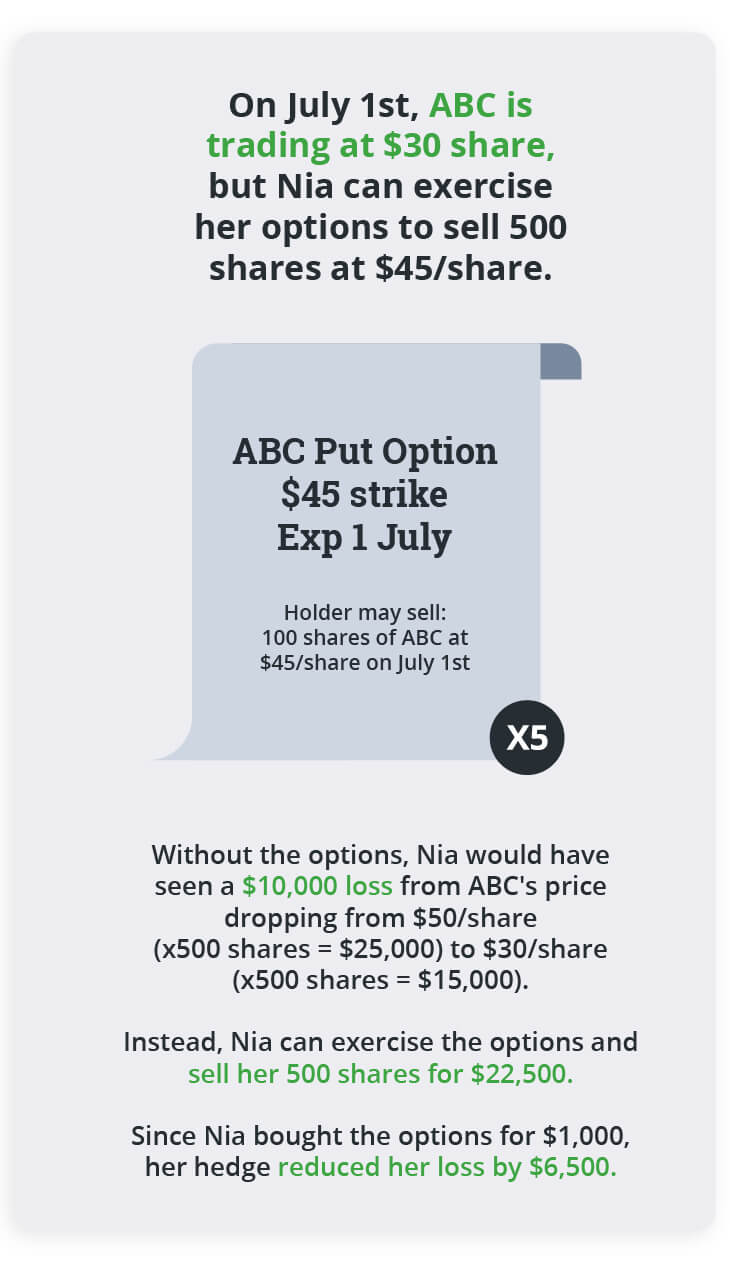

Nia is a trader who currently owns 500 shares of ‘ABC’ trading at $50 per share, and is worried about the shipping delays affecting the company’s manufacturing. Anticipating a drop in share price, Nia buys five put contracts (representing her 500 shares) with a strike price of $45, and an expiration date 6 months out.

In this example, Nia is using Puts as a Hedging strategy, protecting her original investment of 500 shares by creating a “price floor” or minimum price she can sell at. Nia pays $2 per put contract for a total of $1,000 in option premiums ($2 * 5 contracts * 100 options multiplier).

If ABC drops in price to $30 with increasing manufacturing problems and shipping delays, Nia can exercise her 5 put contracts to sell her shares at the strike price of $45. With this strategy, Nia will only book a $3,500 loss ($1,000 options premium + $2,500 loss in share price), instead of a loss of $10,000 if she had to sell at $30.

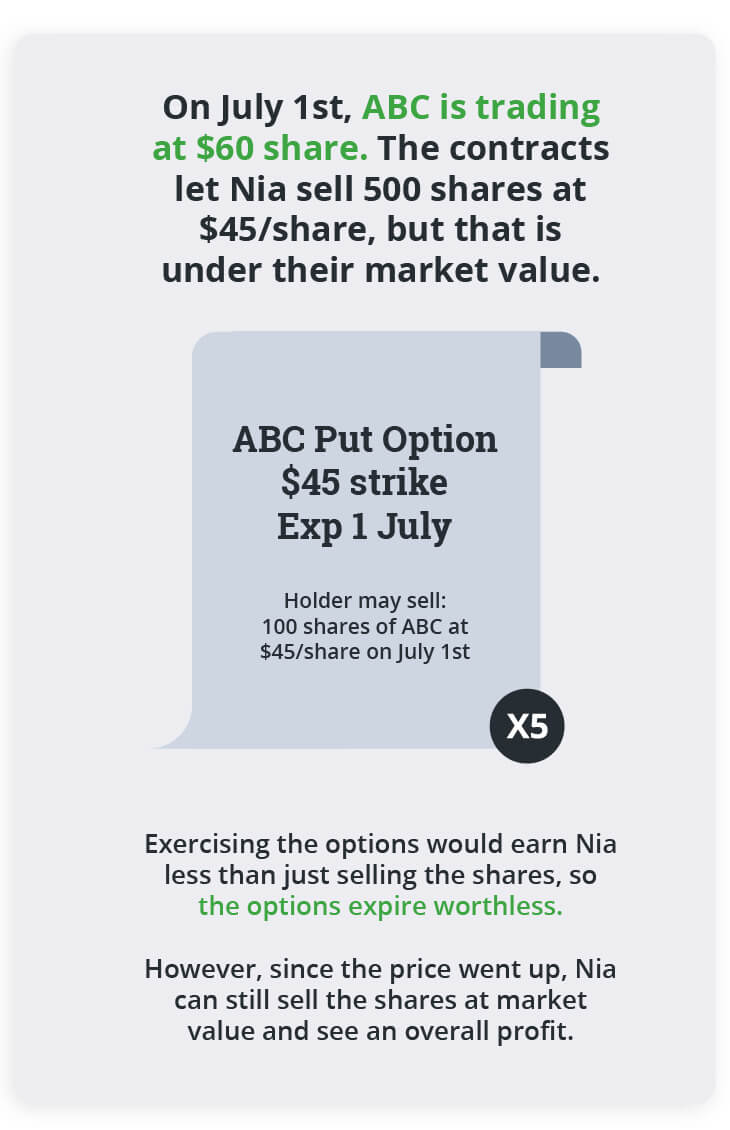

If ABC does not drop in price, but rather increases to $60, Nia’s puts will most likely expire worthless, and she will lose the $1,000 premium paid. If she chooses to sell her shares however, she can lock in a gain of $5,000 (minus the $1,000 premium for the puts).

Example 3 - Selling a Call:

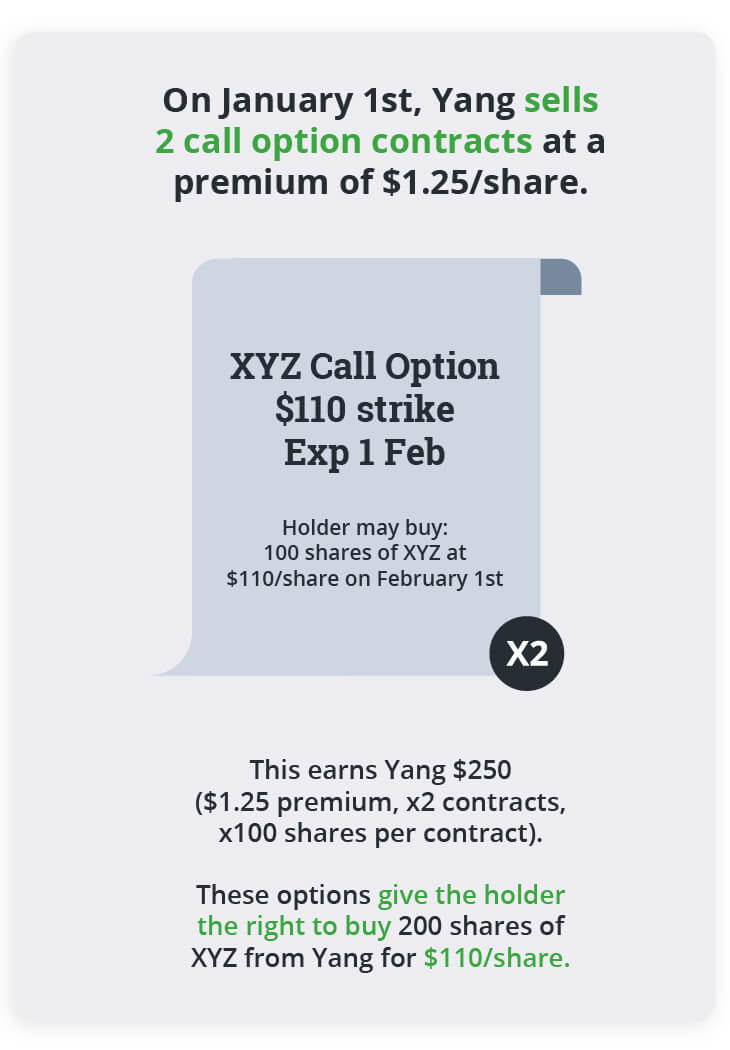

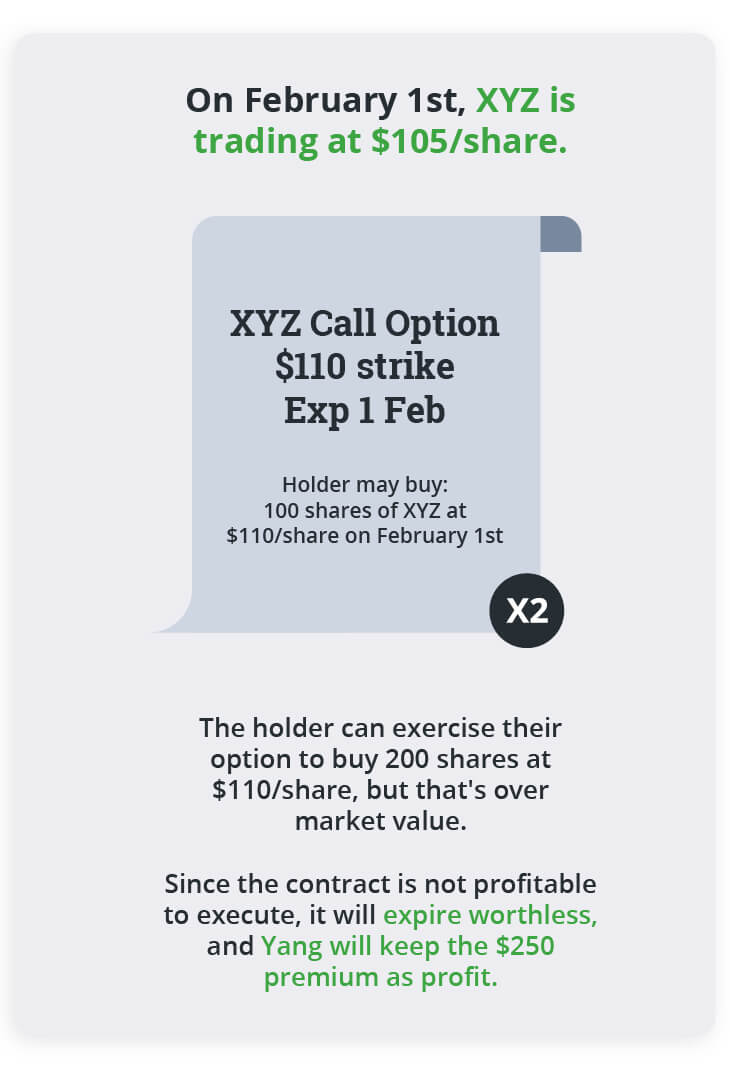

Yang is an investor who currently owns 200 shares of ‘XYZ’ trading at $100 per share, and does not anticipate the price to move significantly in either direction. He’d like to earn some additional income while his shares of XYZ are ‘trading sideways’ so he sells 2 call contracts at a strike price of $110, with an expiration date 1 month away, for a premium of $1.25 each.

His total income from selling the calls is $250 ($1.25 * 2 contracts * 100 options multiplier).

If by the end of the month, XYZ has not reached a price per share of $110, the calls will expire worthless, and Yang will keep the premium as profit.

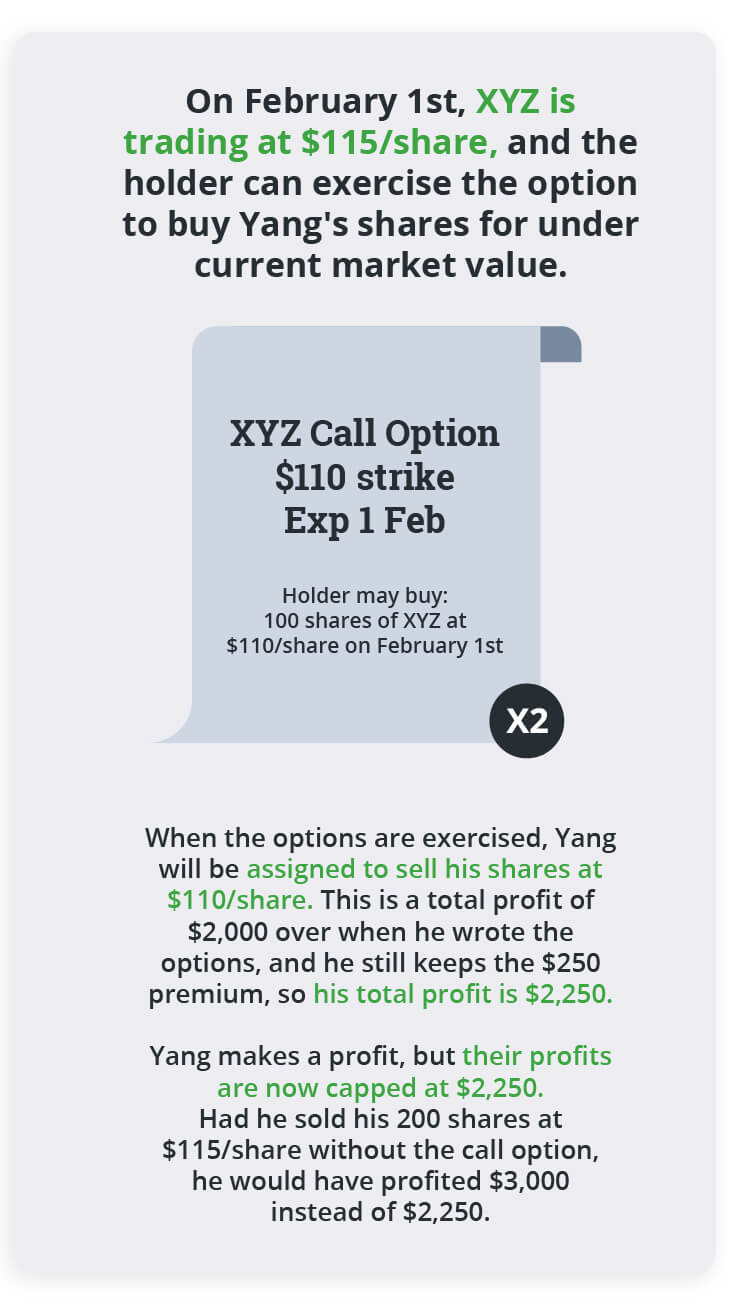

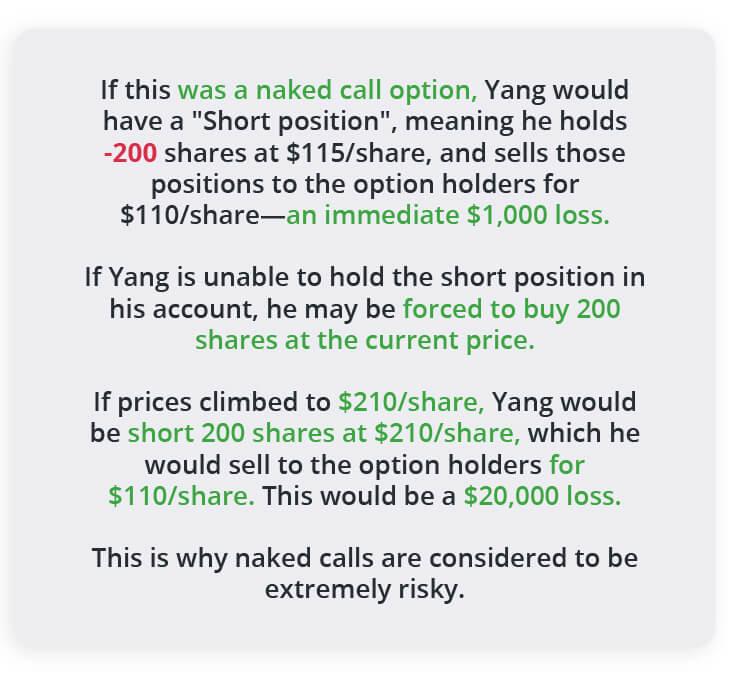

If by the end of the month, XYZ is trading at $115, it is very likely that Yang’s calls will be exercised and he will be assigned to sell his 200 shares of XYZ to the buyer of the calls at only $110 per share (the strike price).

In this example, Yang will profit on the initial $250 in premiums, and the $10 increase in share price from $100 to $110 for a total profit of $2,250. However, Yang will lose the ability to profit on the per share increase from $110 to $115 for a total of $1,000 in missed potential gains.

Example 4 - Selling a Put:

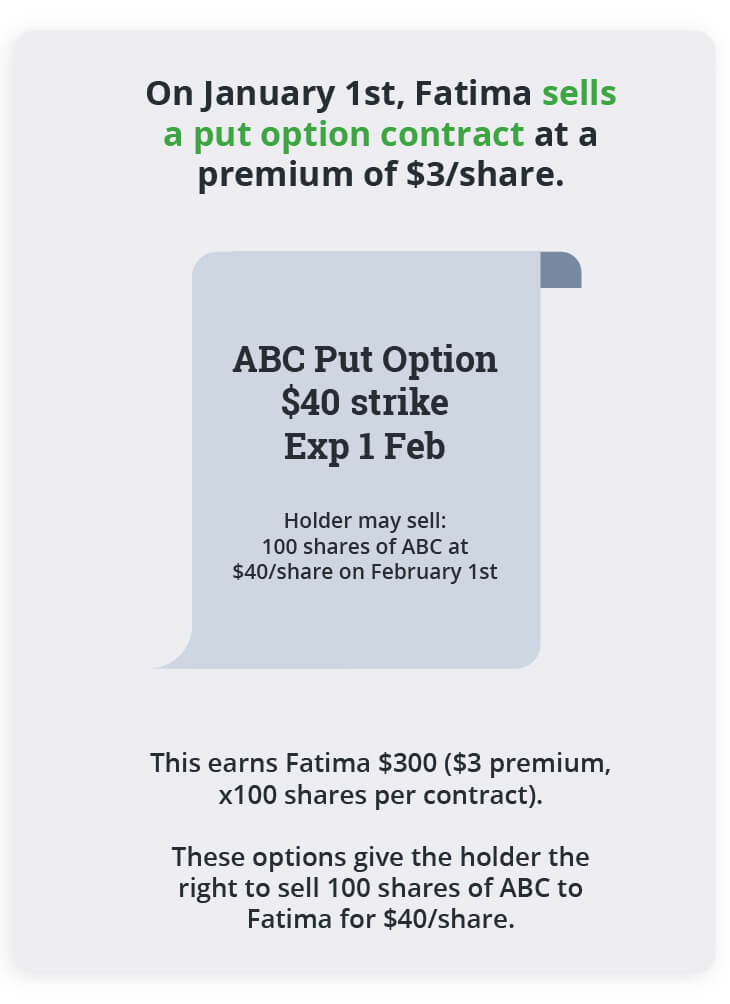

Fatima is a trader who is looking to buy shares of ‘ABC’ that is currently trading for $50, but would like to buy the shares at a discount - around $40 if possible. She can simply wait and see if the shares drop in price to $40, however she can also sell a put as part of a strategy.

Fatima decides to sell 1 put contract on ABC with a strike price of $40 for a premium of $3, she immediately books a profit of $300 in total premiums ($3 * 100 options multiplier).

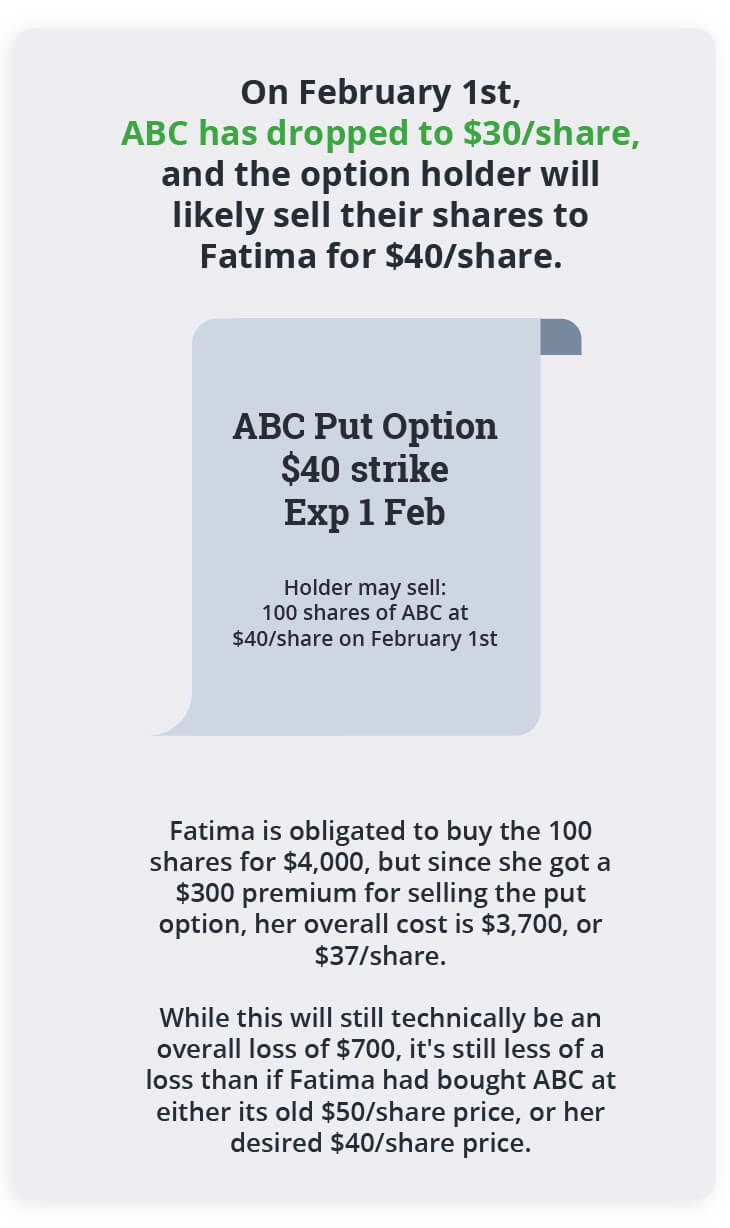

If ABC declines in price below $40, it is very likely that Fatima’s put will be exercised and she will be assigned to buy 100 shares of ABC at the strike price of $40.

Because Fatima booked the $3 profit per share in premiums earlier, this reduces her cost basis for ownership of ABC to only $37 per share ($40 strike - $3 premiums received). If she plans to own ABC all along, this strategy enables her to collect the premium while waiting for her opportunity to buy shares at a discount.

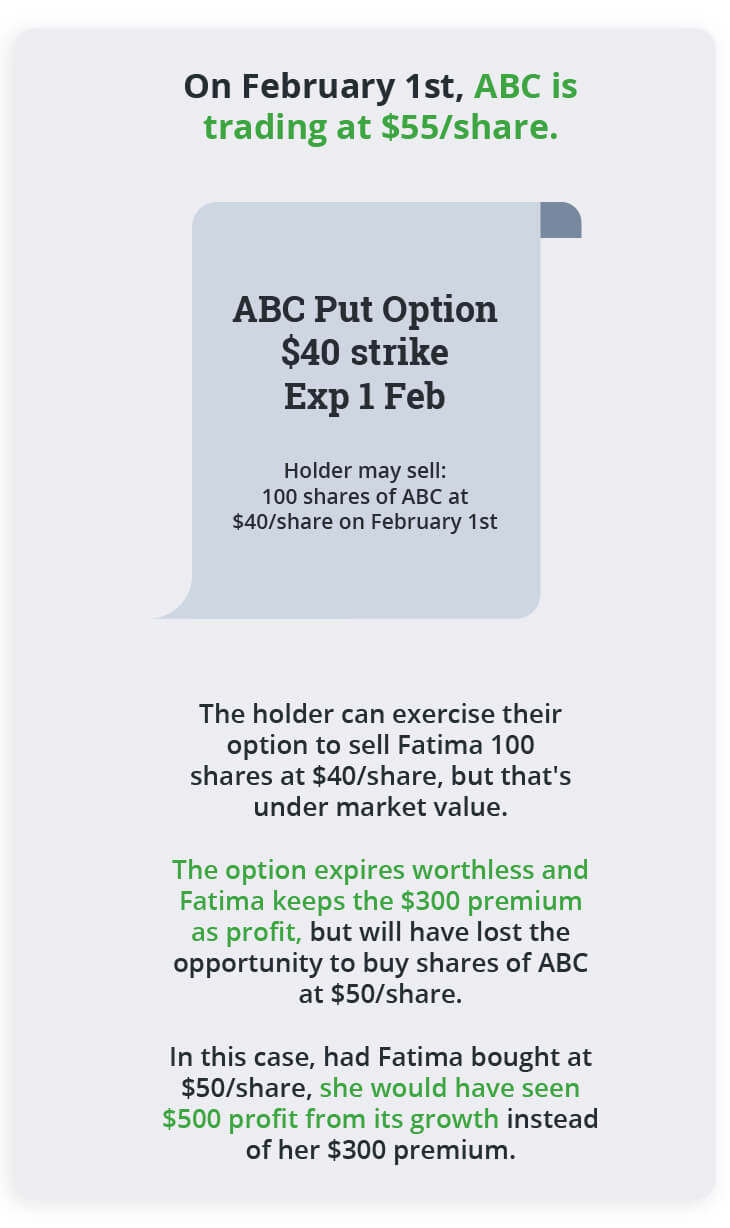

If ABC however does not reach $40 in price before the put expires, Fatima will keep the premium as profit, however she may lose the opportunity to buy the shares at the price she’s looking for.

Note: Securities shown are for illustrative, educational, and visual purposes only, and should not be relied upon as financial advice. The information provided is not intended to be and should not be construed as a recommendation, offer, or solicitation to buy or sell.

Transactions in options can carry a high degree of risk, and may not be suitable for investors with a limited risk profile. Purchasers and sellers of options should familiarize themselves with the type of option (i.e. put or call) they contemplate trading and the associated risks.

Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Related lessons

Want to dive deeper?

Advanced options trading

Get a comprehensive introduction to options trading strategies, and how options levels work.

View lessonRead next

Margin 101

Learn about using a non-registered account and important information when leveraging it for your investments.

View lessonExplore

Investing foundations

Understand the fundamentals and major concepts in investing to help you build a solid investing foundation.

View lesson