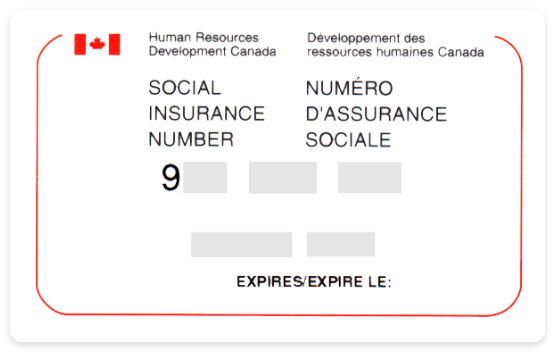

Has your Social Insurance Number (SIN) changed or expired? We can assist you with that.

As part of CIRO and CRA reporting requirements, we are legally required to have a valid SIN number on file for your accounts. SINs allow us to identify you for tax reporting purposes with the CRA, and are incredibly important to keep updated for future tax slips & etc.

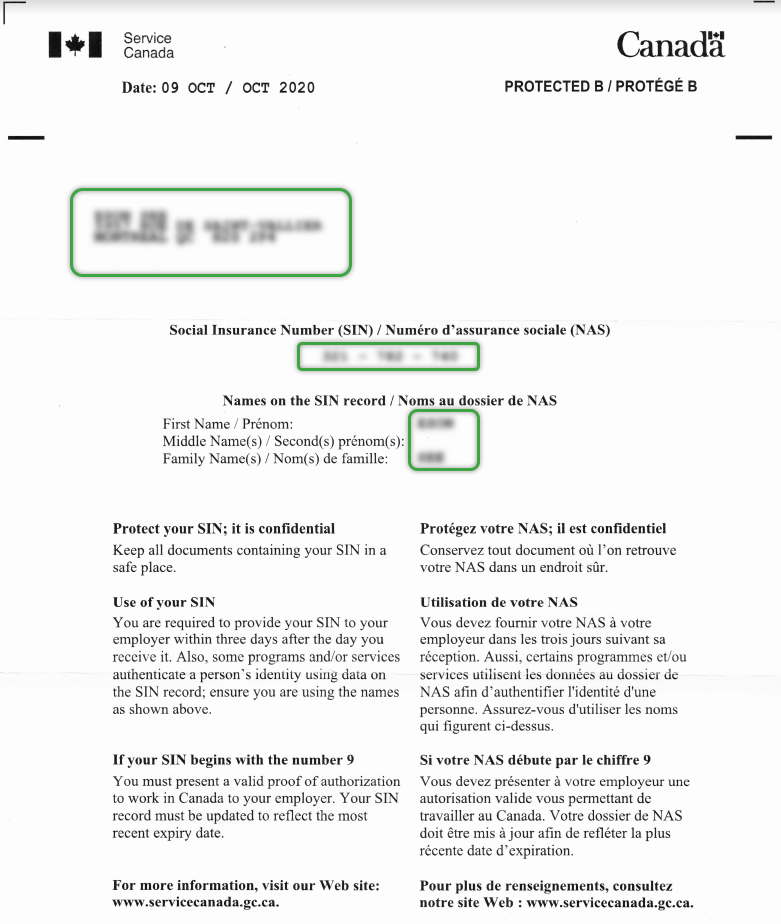

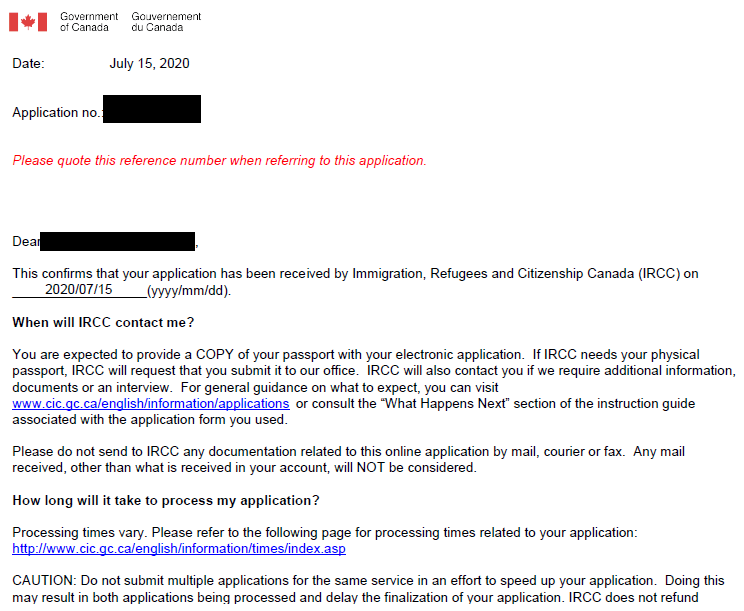

Your SIN number may expire or change for a variety of reasons, such as a new permanent residency status, or if you have renewed a work/study permit. If this is the case, please update your SIN on file with us, and provide documentation to verify this change.

If your SIN has expired, we are unable to accept certain deposits or contributions into your account until this is fixed and updated.

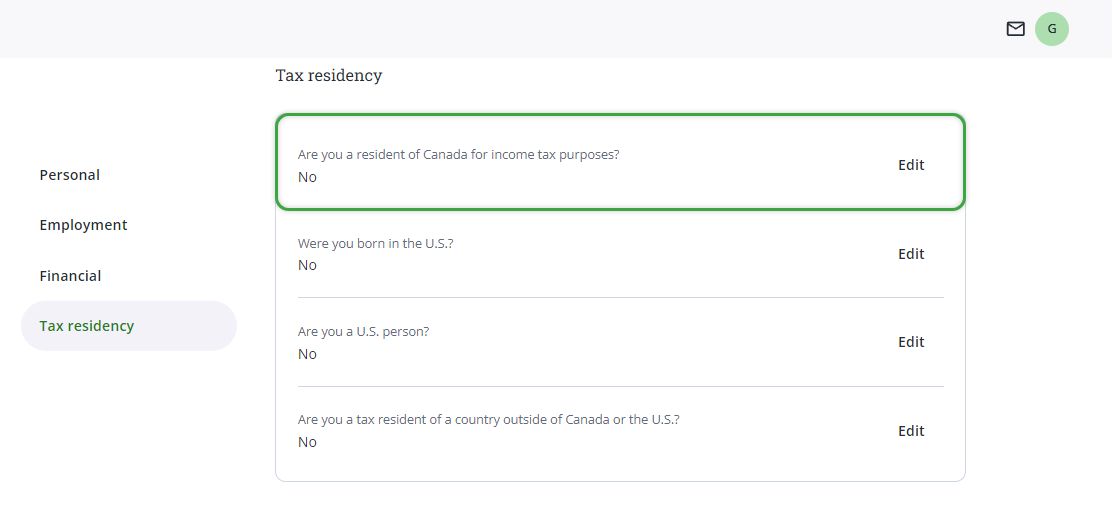

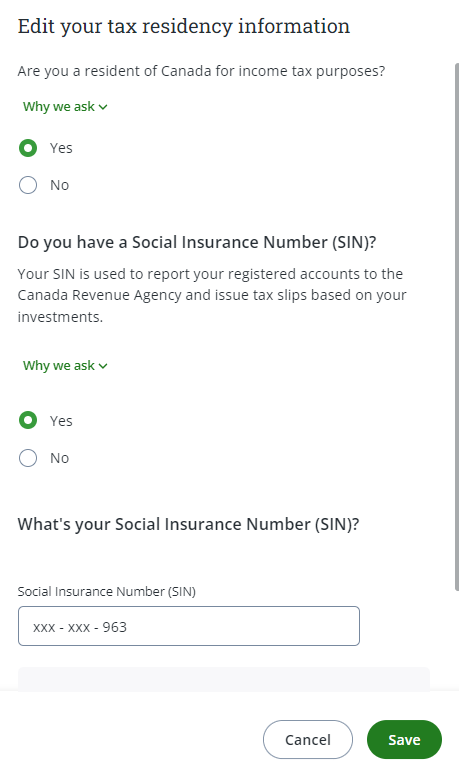

Updating your SIN

To update your SIN number on file with Questrade, please follow these simple steps:

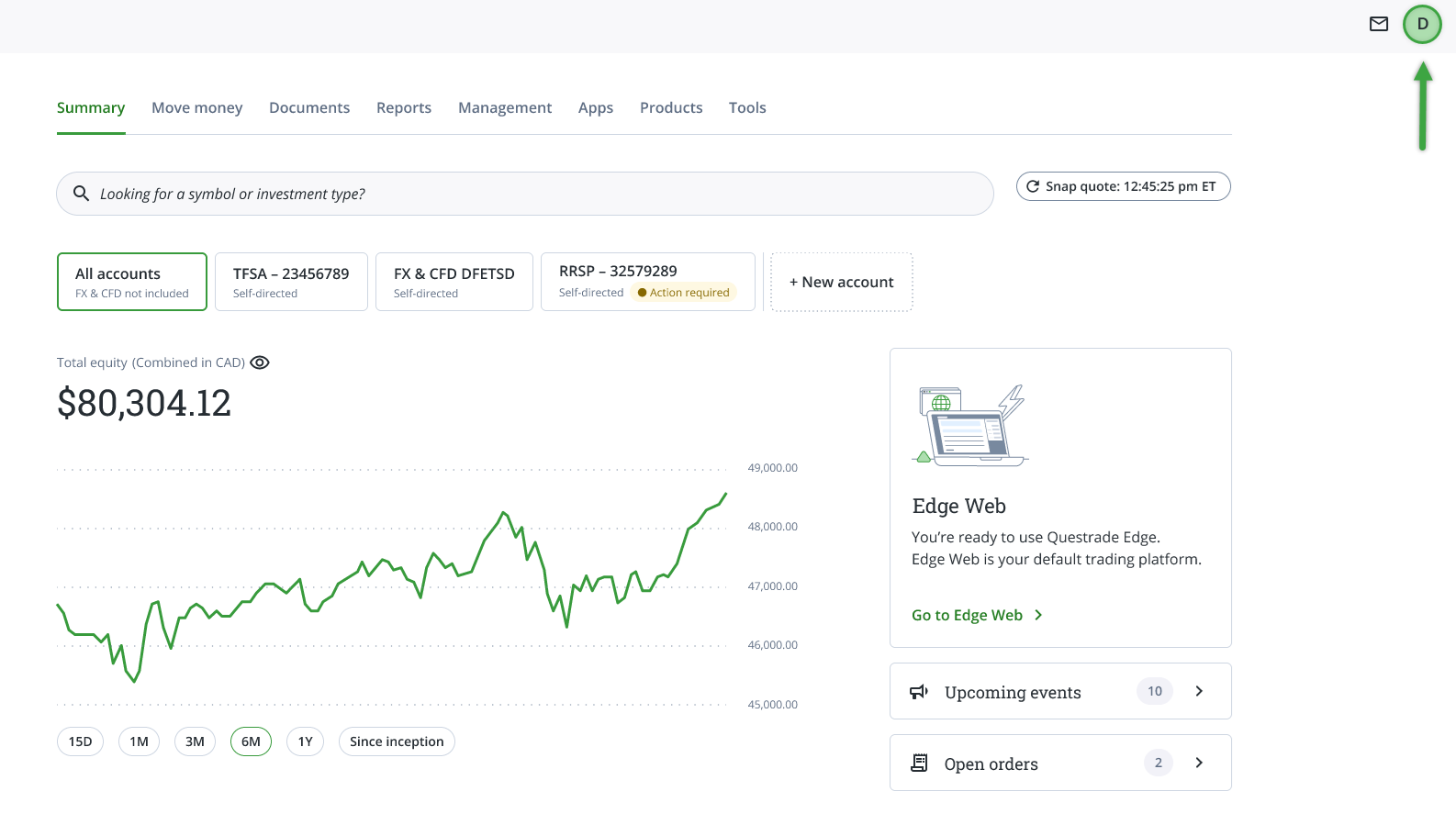

Step 1: Log-in to your Questrade account. To ensure your connection is secure for a SIN update, look for the small ‘padlock’ icon next to the web address in your browser.