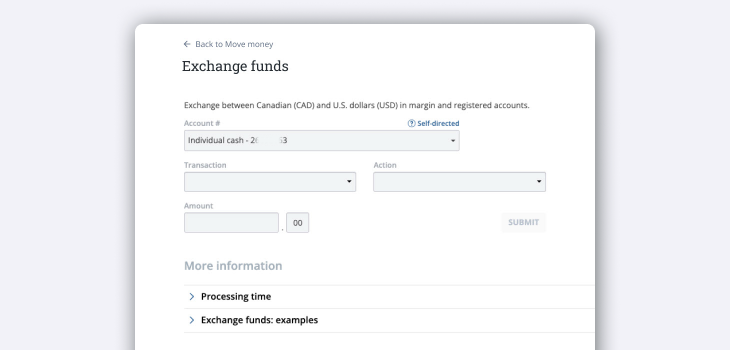

- Since Questrade accounts support dual-currency investing in both Canadian and U.S. Dollars, from time to time, you may need to exchange currencies in your account.

- Depending on which account type you trade from, (non-registered Margin, or registered) you may or may not need to manually place requests to exchange your funds.

Check out the sections below for more information on the 2 account types: