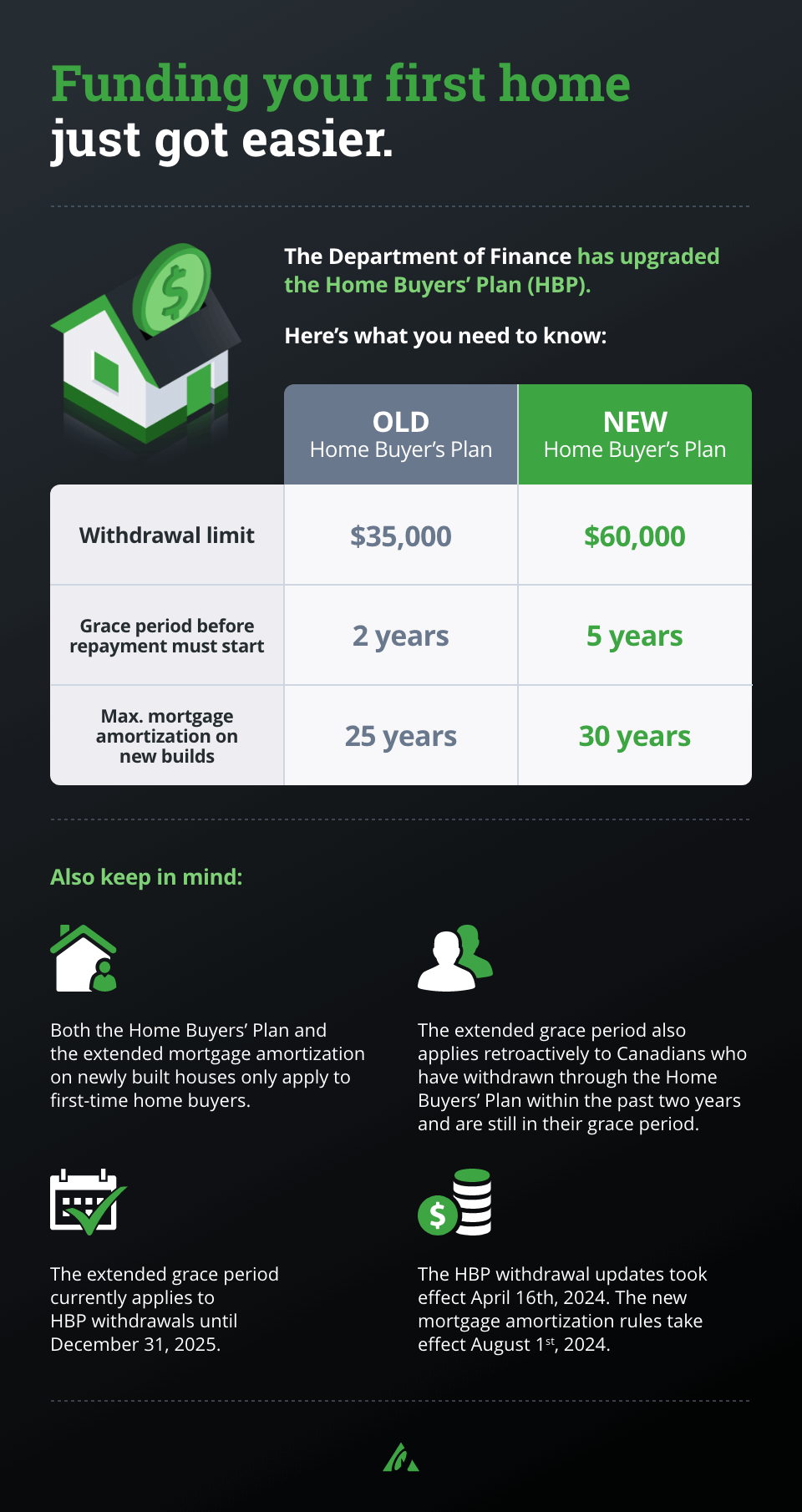

The Home Buyers’ Plan (HBP), a program offered by the Government of Canada, is designed to help Canadians with making the big move of purchasing their first home. The program allows RRSP account holders to withdraw money out of their account tax-free when the proceeds are used towards purchasing a qualifying home. Once you withdraw the funds, you have up to 15 years to pay it back. There is currently a five year grace period before repayments begin. Please note: The extended grace period currently applies to HBP withdrawals made between January 1, 2022, and December 31, 2025.

Unless you have a disability (or are helping a relative who has one) to buy or build a home, you have to be a first-time home buyer to qualify for this program. To be considered as a first-time home buyer, you must have not owned a home which is your principal residence in the last 4 years before withdrawing the funds from your RRSP for a home purchase. As well, RRSP contributions must be held in the RRSP for at least 90 days before they qualify to be withdrawn to participate in the HBP.

To get a more in-depth information about the Home Buyers' Plan, please take a look at this helpful page from the CRA website.

Note that qualifying account holders can withdraw funds from more than one RRSP account. For example, if you and your spouse each have an individual RRSP and choose to participate in the plan, you can withdraw a combined maximum of $60,000 per person for a total of $120,000. If you have an individual RRSP and also a Spousal RRSP, you can withdraw a combined maximum of $60,000 CAD (or CAD-equivalent) under the HBP.