Are you a Canadian investor looking to explore the world of bonds? Whether you're new to investing or want to diversify your portfolio, understanding the basics of bonds can be invaluable.

In this article, we'll explain what bonds are, the different types available to invest in, key terms, and common characteristics of each type of bond. We'll also provide examples specific to the Canadian market, helping you make informed decisions when trading and investing in bonds.

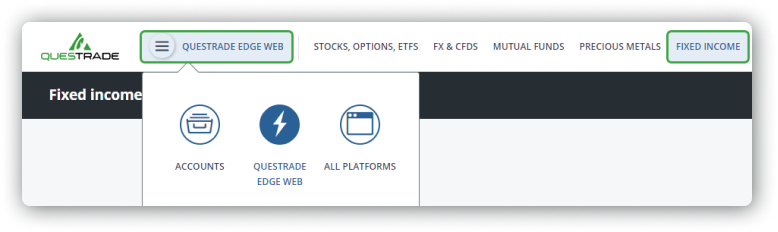

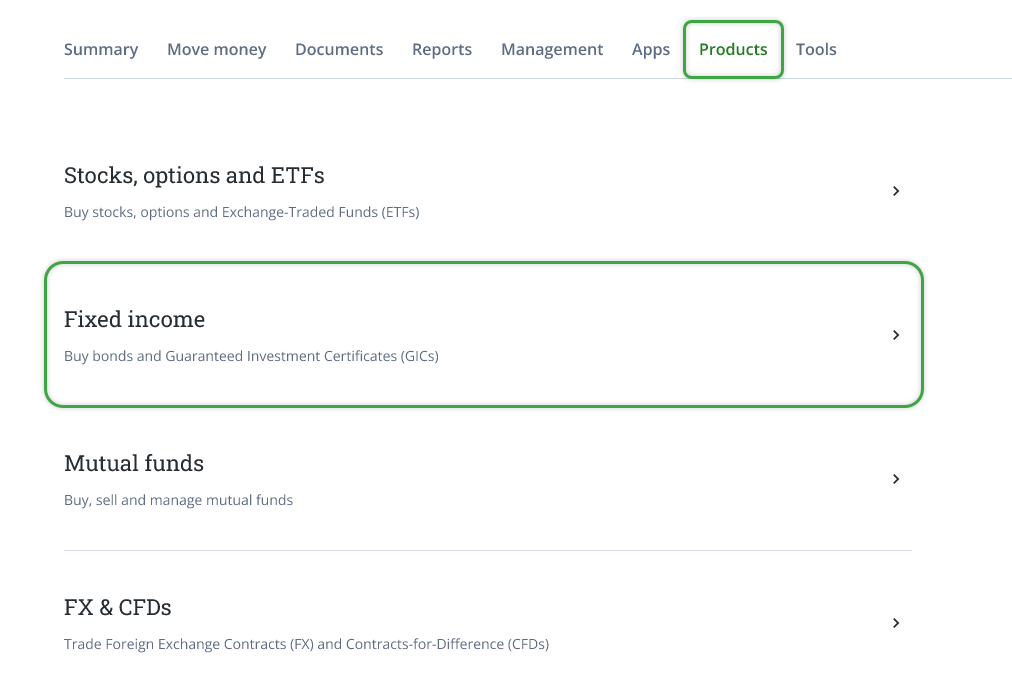

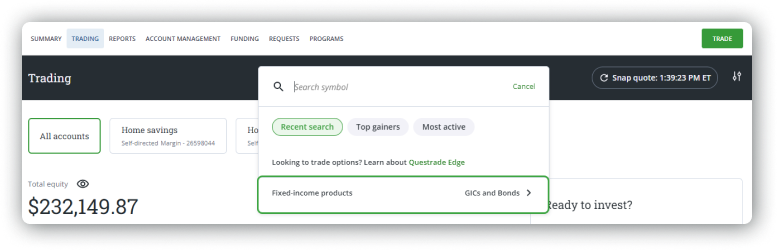

Learn more about trading bonds using the Questrade platforms in this article.