When you place orders to buy or sell securities on our platform, as your broker we’re required to take your orders and send them to the market to be filled. The process of filling your order is referred to as "trade execution.” An order is considered executed when it gets filled—meaning you received or sold the shares—and not when the order is placed by the investor as not every order you place will necessarily get executed.

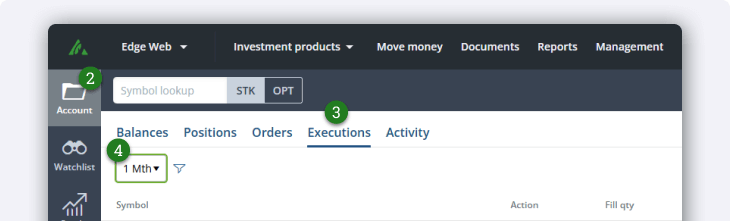

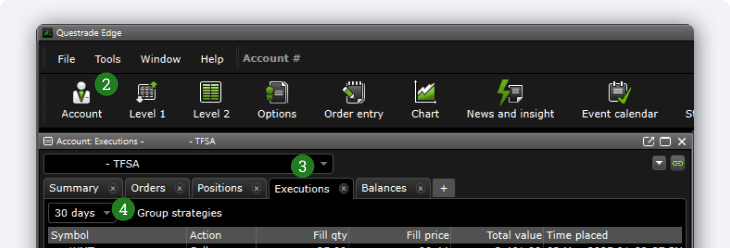

The Execution tab allows you to conveniently track your executed orders for the current day or for a certain time period you choose. Below, under the name of the trading platform you use, learn more about how to view and interpret information in this tab.

Note: This help article is for the Edge Web and Edge Desktop platforms specifically.

Head to Explore QuestMobile, or Introduction to Questrade Trading for questions about those platforms.